tax on unrealized gains bill

Biden also called for the top capital gains tax rate to be the same as his top proposed rate on other income at 396. Ad Make Tax-Smart Investing Part of Your Tax Planning.

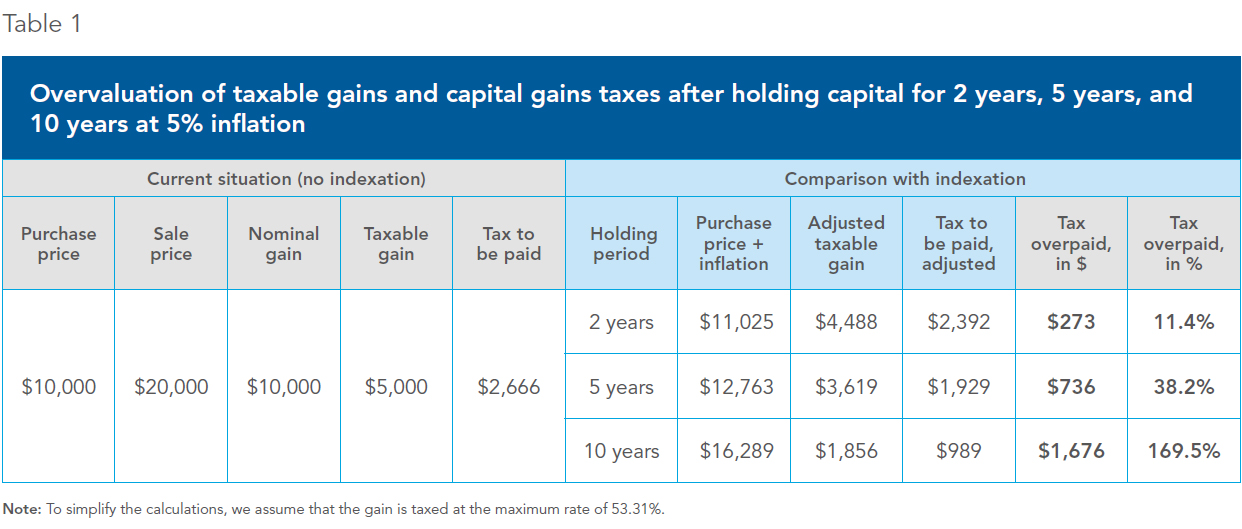

The Capital Gains Tax And Inflation How To Favour Investment And Prosperity Iedm Mei

Ad From Simple to Advanced Income Taxes.

. For these 13 billionaires total unrealized gains add up to more than 1 trillion. The largest part of the tax bill will be upfront. When including unrealized capital gains as income the households effective tax rate is 12 percent below the proposed 20 percent minimum.

Is expected to lose almost 42 billion in tax revenue this year from the exclusion of capital. A tax on unrealized gains is clearly not in compliance with Article I Section 9 nor is it covered under the 16th Amendment which the Supreme Court explicitly ruled in Eisner v. Ad See If You Qualify For IRS Fresh Start Program.

To prohibit the implementation of unrealized capital gains taxation. President Bidens Fiscal Year 2023 budget includes a new tax on unrealized gains. Based On Circumstances You May Already Qualify For Tax Relief.

Kyrsten Sinema D-Ariz and Joe Manchin D-WV to 2 trillion. The proposal is likely dead on arrival as it doesnt have the votes in Congress but in its present form it would levy a 20 minimum tax on all income including not just realized. The tax will charge a long-term cap gains rates on all unrealized monies for tradeable investments which includes stocks bonds.

And a mark-to-market system isnt the only. The first of these is a proposal to implement a so-called mark-to-market regime for taxing unrealized capital gains. All the extras are included free.

Quickly Prepare and File Your 2021 Tax Return. If you have a 500000 portfolio be prepared to have enough income for your retirement. Plans include an alternative minimum tax on corporate book income an excise tax on stock buybacks and a tax on unrealized capital gains for billionaires.

The Democrats plan for a 35 trillion spending bill has been pared by moderate lawmakers led by Sens. Even though reports suggest the proposed. Ad Browse Discover Thousands of Law Book Titles for Less.

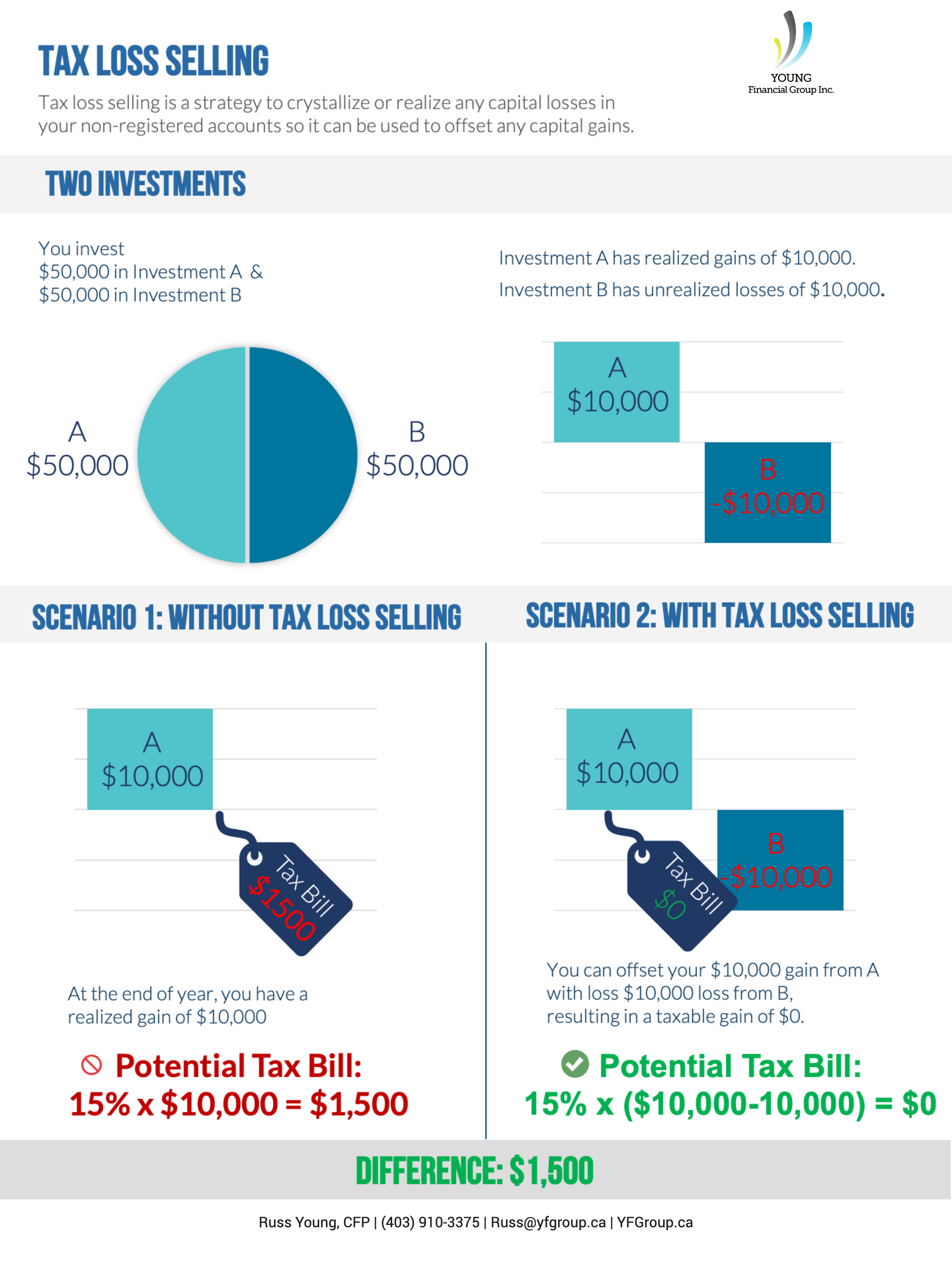

Ad Download The 15-Minute Retirement Plan by Fisher Investments. Any fair tax system would give that investor the ability to offset gains with losses as is generally the case elsewhere in the tax code. The tax would apply to 1 million of that 2 million gain due to the exclusion.

Guaranteed max refund and always free federal tax filing. Of all the many revenue-raising ideas that have bubbled up out of Washington the recent proposal to tax unrealized capital gains is particularly jarring. House Speaker Nancy Pelosi took issue with plans by fellow Democrats to levy a tax on unrealized capital gains to help pay for President Bidens 175 trillion social spending bill.

Ad Download The 15-Minute Retirement Plan by Fisher Investments. To increase their effective tax rate. Prohibition on the implementation of new federal requirements to tax unrealized capital.

Yet that concept could change for billionaires pending an unrealized gains tax proposed by the Biden Administration in late March 2022. If you have a 500000 portfolio be prepared to have enough income for your retirement. This tax called a billionaire minimum income tax would impose an annual 20 percent tax on.

Currently taxpayers pay tax only on realized capital gains in. Senate Finance Committee Chairman Ron Wyden D. The proposal would allow billionaires to pay this initial tax over five years rather than all at once.

Free Case Review Begin Online. Connect With a Fidelity Advisor Today. At the current top.

Theres been a lot of debate this week over President Bidens latest budget plan which includes a proposed tax on the unrealized gains of assets owned by billionaires. Under the proposed Billionaire.

The Unintended Consequences Of Taxing Unrealized Capital Gains

Capital Gains Tax Canada Managing Capital Gains Taxes

Tax Loss Selling Young Financial Group

The Us Government Wants To Tax Unrealized Gains Crypto Investment Tips Mtltimes Ca

How Biden S Tax Hike Could Affect Crypto Holders

The Unintended Consequences Of Taxing Unrealized Capital Gains

Understanding Taxes And Your Investments

The Us Government Wants To Tax Unrealized Gains Crypto Investment Tips Mtltimes Ca

Manchin Denounces Billionaires Tax As Divisive The New York Times

The Capital Gains Tax And Inflation How To Favour Investment And Prosperity Iedm Mei

The Us Government Wants To Tax Unrealized Gains Crypto Investment Tips Mtltimes Ca

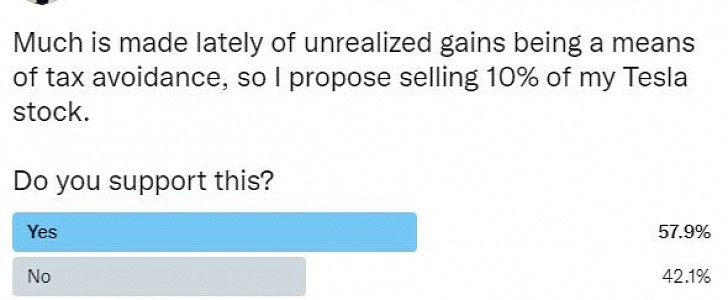

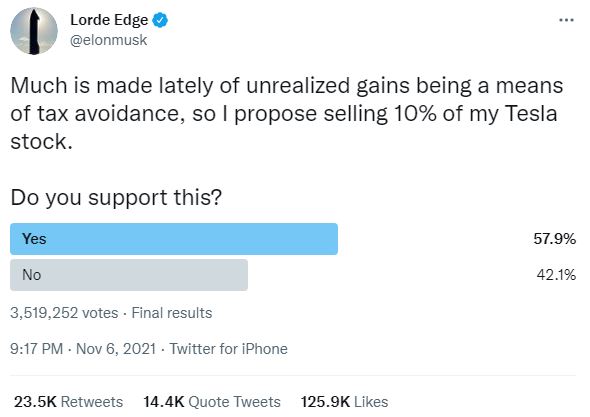

Elon Musk Will Sell Tesla Shares To Pay Taxes The People Have Spoken Autoevolution

The Coming Tax On Unrealized Capital Gains Read Now

Elon Musk Will Sell Tesla Shares To Pay Taxes The People Have Spoken Autoevolution

Us Government Unrealized Gains Tax Plans Might Hit Crypto Billionaires Too

What Is Unrealized Gain Or Loss And Is It Taxed

The Capital Gains Tax And Inflation How To Favour Investment And Prosperity Iedm Mei

Confusing U S Tax Laws Lead To 5 Billion In Unrealized Crypto Losses

The Us Government Wants To Tax Unrealized Gains Crypto Investment Tips Mtltimes Ca